Financial Minimalism: How to Reduce Expenses and Increase Quality of Life

Understanding Financial Minimalism

In an era characterized by rampant consumerism, embracing the tenets of financial minimalism can herald a profound shift in how we perceive and manage our money. This movement transcends merely slashing expenses; it is fundamentally about enhancing your overall quality of life while fostering financial stability. Imagine adopting a lifestyle that prioritizes intentionality in financial decisions, allowing for more space to pursue personal growth and self-improvement.

At the core of financial minimalism lie several pivotal principles that aim to streamline your financial journey:

- Reduced Expenses: Begin by auditing your monthly expenditures. Identify recurring charges, subscriptions, or luxury items that add little value to your daily life. For instance, in Nigeria, many individuals have discovered that cutting back on unnecessary data plans or multiple streaming service subscriptions can significantly free up their budgets.

- Mindful Consumption: Shift your mindset from acquiring new gadgets to cherishing experiences that contribute to your well-being. Instead of spending on the latest smartphones, consider investing in travel within Nigeria, exploring destinations like Obudu Cattle Ranch or the serene beaches of Lekki. Focusing on experiences can often lead to more enduring happiness than temporary material gains.

- Financial Freedom: Establish a budget that emphasizes savings and practical investments. Prioritize setting aside funds for emergencies or future goals, such as education or home ownership. By creating a financial roadmap, you not only gain clarity on your spending habits but also cultivate a sense of security.

In the Nigerian context, the principles of financial minimalism are becoming increasingly vital. With ongoing issues like inflation, which recently surged to notable levels, and currency fluctuations impacting purchasing power, finding ways to cut costs has become essential for achieving financial security. By adopting a minimalist viewpoint, more Nigerians are enhancing their spending discipline and, as a result, gaining not only financial health but also increased mental clarity and satisfaction.

As we delve further, practical strategies will reveal ways to reduce expenses while simultaneously enriching your daily life. From the importance of eliminating debt to cultivating resources that truly matter—be it relationships or skills—financial minimalism opens the door to a future brimming with fulfillment and prosperity. The journey invites you not only to save money but to enhance your life’s quality, freeing yourself from the shackles of consumer pressure and leading to a resilient, empowered existence.

Embracing financial minimalism is not merely a trend; it is a mindset shift that encourages thoughtful living. As you explore these concepts, you will find opportunities to redefine what financial success means, ultimately leading to greater happiness and personal satisfaction.

ADDITIONAL INSIGHTS: Expand your understanding here

Practical Steps to Embrace Financial Minimalism

To fully realize the benefits of financial minimalism, it is essential to implement practical steps that can transform your spending habits and overall lifestyle. This journey begins with a thorough evaluation of your finances, empowering you to make intentional choices that align with your values and life goals. Here are several actionable strategies that can help you to reduce expenses significantly while enhancing your quality of life:

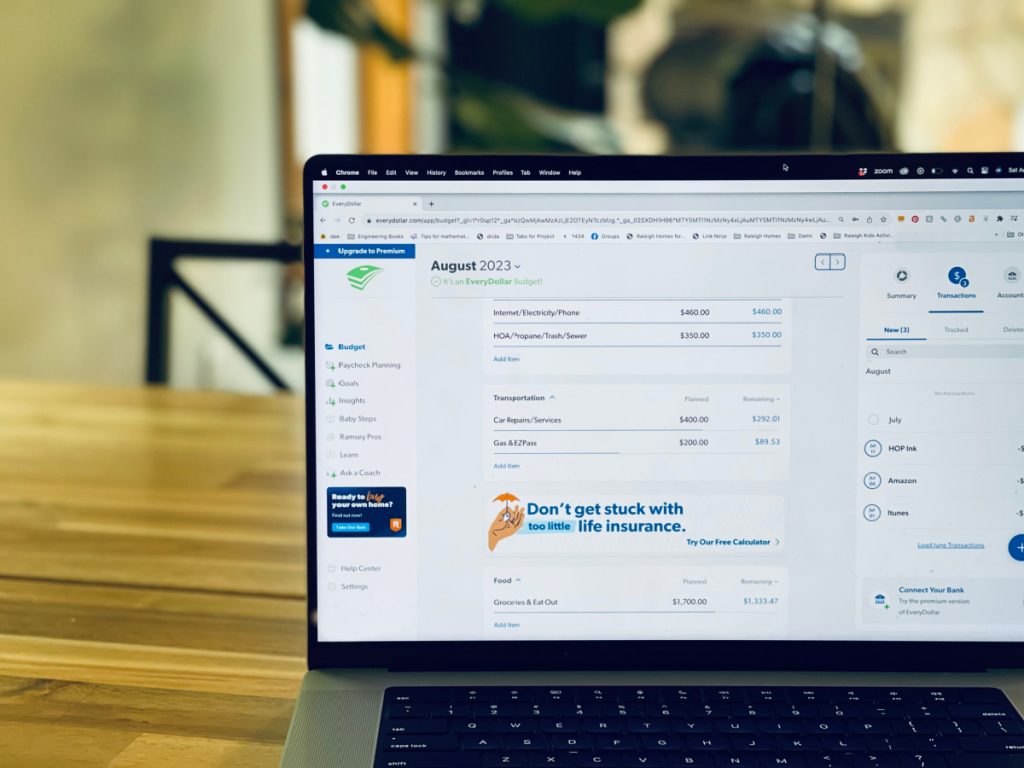

- Conduct a Financial Audit: Start by reviewing your bank statements and monthly expenses. Categorize your spending to identify where your money is going. This involves pinpointing areas of excess, such as dining out, entertainment, or subscriptions you rarely use. In Nigeria, people often find that simply limiting the frequency of dining at fast food outlets can translate into substantial monthly savings.

- Embrace a “31-Day No-Spend Challenge”: Commit to not making any unnecessary purchases for one month. This challenge can derail impulse buying tendencies and expose the depth of your habitual spending. Participants often discover they can thrive without these extra expenditures, shifting their focus towards experiences rather than commodities.

- Choose Quality Over Quantity: Invest in durable products that may have a higher upfront cost but save you money in the long run. Whether it’s clothing, electronics, or household items, opting for quality can reduce the frequency of replacements needed.

- Streamline Your Subscriptions: Review all subscription services you use and analyze their value. Are you actively utilizing them? Cutting down on multiple streaming platforms or magazine subscriptions can free up funds that can be redirected towards experiences, travel, or savings.

Incorporating these strategies into your routine can illuminate how financial minimalism intertwines with improved well-being. It fosters an environment where stress over money diminishes, allowing for more time spent with family and loved ones, as opposed to being consumed by the need to acquire material goods.

Moreover, embracing minimalism can lead to environmental sustainability, as purchasing fewer products means less waste. It encourages consumers to reevaluate their purchases in terms of necessity, prompting a more eco-conscious lifestyle that resonates with many Nigerians concerned about the implications of consumerism on our planet.

As you implement these strategies, remember that the essence of financial minimalism lies not solely in frugality, but in intentional living. This approach frames personal finance as a tool for enhancing your life’s quality rather than a restrictive measure. By taking deliberate actions to cut expenses, you can cultivate a richer, more rewarding experience where each purchase is made with thoughtfulness and purpose.

Ultimately, the principles of financial minimalism can create a cascade of positive changes, fostering not only financial health but also emotional and psychological well-being. With fewer material distractions, you can create space for what truly matters, amplifying your satisfaction and joy in life’s experiences.

| Category | Key Features |

|---|---|

| Budgeting Tools | Comprehensive insights into spending habits and income, helping you to identify areas where you can cut back. |

| Expense Tracking | Utilizes technology to automate tracking, making it simpler to monitor your finances and avoid unnecessary expenditures. |

| Financial Literacy | Promotes an understanding of important financial concepts which leads to informed decision-making. |

| Savings Strategies | Encourages methods like the 50/30/20 rule to diversify savings and increase financial security. |

In exploring the principles of financial minimalism, it’s vital to recognize that embracing simplicity in fiscal matters can lead to a healthier quality of life. The above categories illustrate key tools and strategies to help you gain control over your financial situation. By implementing these practices, individuals can pave the way for both reduced expenses and improved financial outcomes. Learning to budget effectively establishes a foundation upon which other aspects of a minimalist lifestyle can be built. Additionally, utilizing technology for expense tracking empowers users to make quick decisions that align with their set financial goals. Furthermore, equipping oneself with financial literacy serves as an essential catalyst for making informed financial choices that transcend momentary indulgences. Together, these components not only assist in mitigating unnecessary expenses but also lay the groundwork for enhanced life satisfaction. The pathway to minimalism lies in understanding how to prioritize needs over wants, ultimately fostering a more stable and enriched life.

LEARN MORE: This related article may interest you

Transforming Mindset Towards Spending

To truly embrace financial minimalism, a shift in mindset is just as crucial as adjusting spending habits. Making changes to how you think about money can have a profound impact on your financial practices and, consequently, your overall quality of life. Here are some approaches that can help alter your perception of spending:

- Shift From Consumerism to Experiences: Research indicates that people often derive more happiness from experiences than from material possessions. Instead of spending money on the latest smartphone or trending fashion, consider allocating that budget towards creating memories, such as travel, workshops, or family outings. In Nigeria, exploring local destinations not only fosters a sense of community but also creates lifelong memories without breaking the bank.

- Practice Gratitude and Contentment: Cultivating a mindset of gratitude can diminish the desire for excess. Keep a journal to note what you appreciate in your life. This practice reduces the urge to purchase things simply for status or validation. Focusing on what you already have, such as a supportive family or a stable job, enables a contented attitude that makes financial minimalism fulfilling.

- Set Meaningful Goals: Financial minimalism is much more rewarding when it is driven by clear goals that align with your values. Whether it’s saving for a home, planning for education, or establishing a retirement fund, having straightforward financial objectives will help you channel your funds towards what truly matters. For instance, many Nigerians are increasingly prioritizing savings for their children’s education, understanding that investing in knowledge is a legacy that lasts.

As you reframe your relationship with money, you’ll likely find that your well-being improves alongside your financial health. The realization that joy is attainable without excessive spending liberates many from the cycle of debt and financial unease.

Creating a Supportive Community

One aspect that often gets overlooked in the journey towards financial minimalism is the power of community. Surrounding yourself with like-minded individuals can bolster your efforts significantly. Consider these ways to build a supportive network:

- Join Local Financial Literacy Groups: Many communities in Nigeria offer workshops or groups aimed at enhancing financial knowledge. Engaging with others can provide both motivation and accountability as you strive to implement financial minimalism.

- Share Your Journey on Social Media: Platforms like Instagram and Facebook can be excellent spaces to share your progress towards financial minimalism. You will not only inspire others but also receive encouragement from fellow minimalists, creating a sense of solidarity in your pursuit of reducing expenses.

- Collaborate on Group Activities: Organizing low-cost group activities, like potlucks, game nights, or study groups can help you maintain social connections without indulging in expensive outings. Nigerian culture often emphasizes community, making these collaborative activities more accessible and enjoyable.

As you develop a mindset supportive of financial minimalism and create networks that align with your values, the journey becomes less isolating. Instead of feeling deprived, you’ll discover camaraderie with others who share the goal of living simply but richly. With every step taken towards a minimalist financial lifestyle, you’re not merely saving money; you’re investing in a life filled with purpose, community, and fulfillment.

SEE ALSO: Click here to read another article

Conclusion: Embracing Financial Minimalism for a Fulfilling Life

In conclusion, financial minimalism is not merely a strategy for cutting costs; it is a transformative lifestyle choice that fosters a greater sense of well-being and satisfaction. By reassessing our spending habits and prioritizing what is truly meaningful, we can shift from temporary gratification to lasting fulfillment. The journey begins by understanding that experiences often bring more joy than material possessions, a notion that resonates deeply within the context of Nigerian culture.

Additionally, practicing gratitude allows us to find contentment in what we already possess, reducing the hunger for unnecessary purchases. Setting clear financial goals focused on long-term aspirations, such as education or home ownership, further empowers us to allocate resources wisely. Importantly, as we embrace this transformative journey, the support of a community engaged in financial literacy can provide valuable motivation and encouragement, reinforcing our commitments to a simpler, more purposeful life.

Ultimately, financial minimalism is about creating a balance—where we cut excess to make room for meaningful pursuits and enriching experiences. The steps involved may require effort and dedication, but the resultant quality of life is undoubtedly worth it. As more Nigerians explore this approach, we might just find that a simpler life, concentrated on genuine connections and cherished moments, leads to greater happiness and personal growth. Such a lifestyle not only promotes financial health but also paves the way for a brighter, more fulfilling future.